Retainer Software

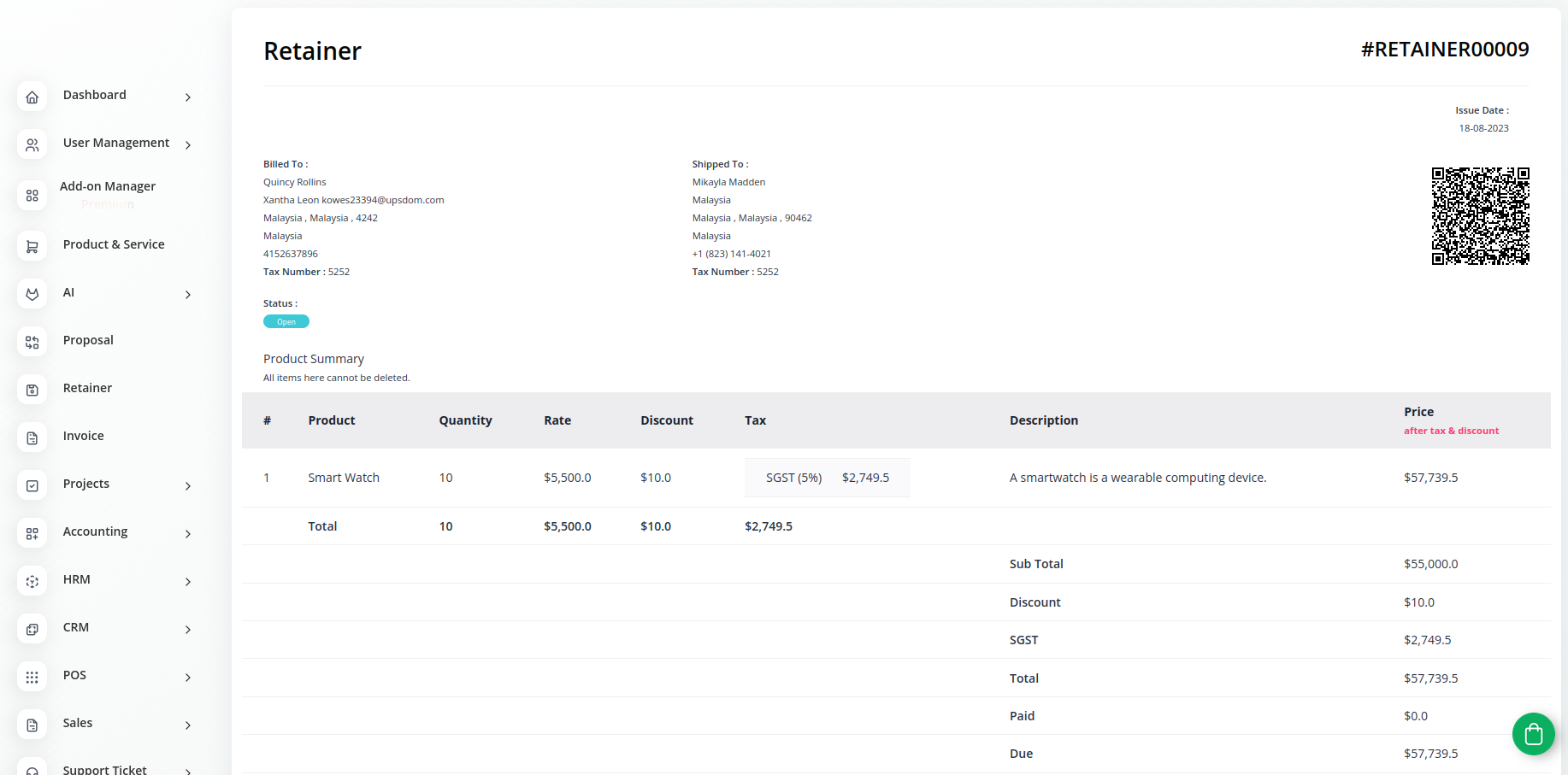

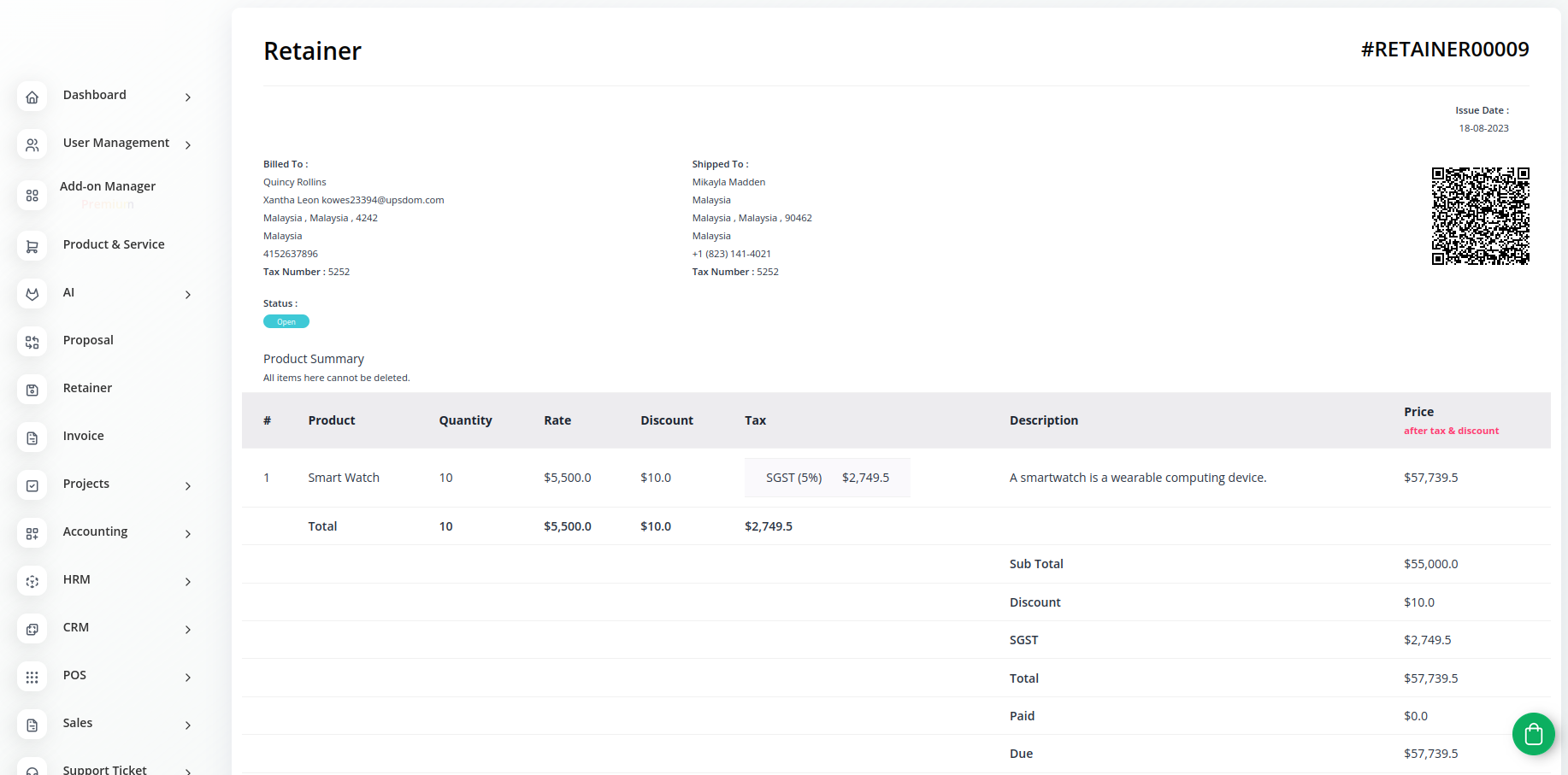

Retainer invoices are documents the firm can provide to the client to ask for funds prior to the project starting.

Its a method of securing services for use when required. In other words, its a form of deposit or pre-payment.

It’s a form of depositor pre-payment

Retainer invoices are documents the firm can provide to the client to ask for funds prior to the project starting. It’s a method of securing services for use when required. In other words, it’s a form of deposit or pre-payment.

What is a Retainer Invoice

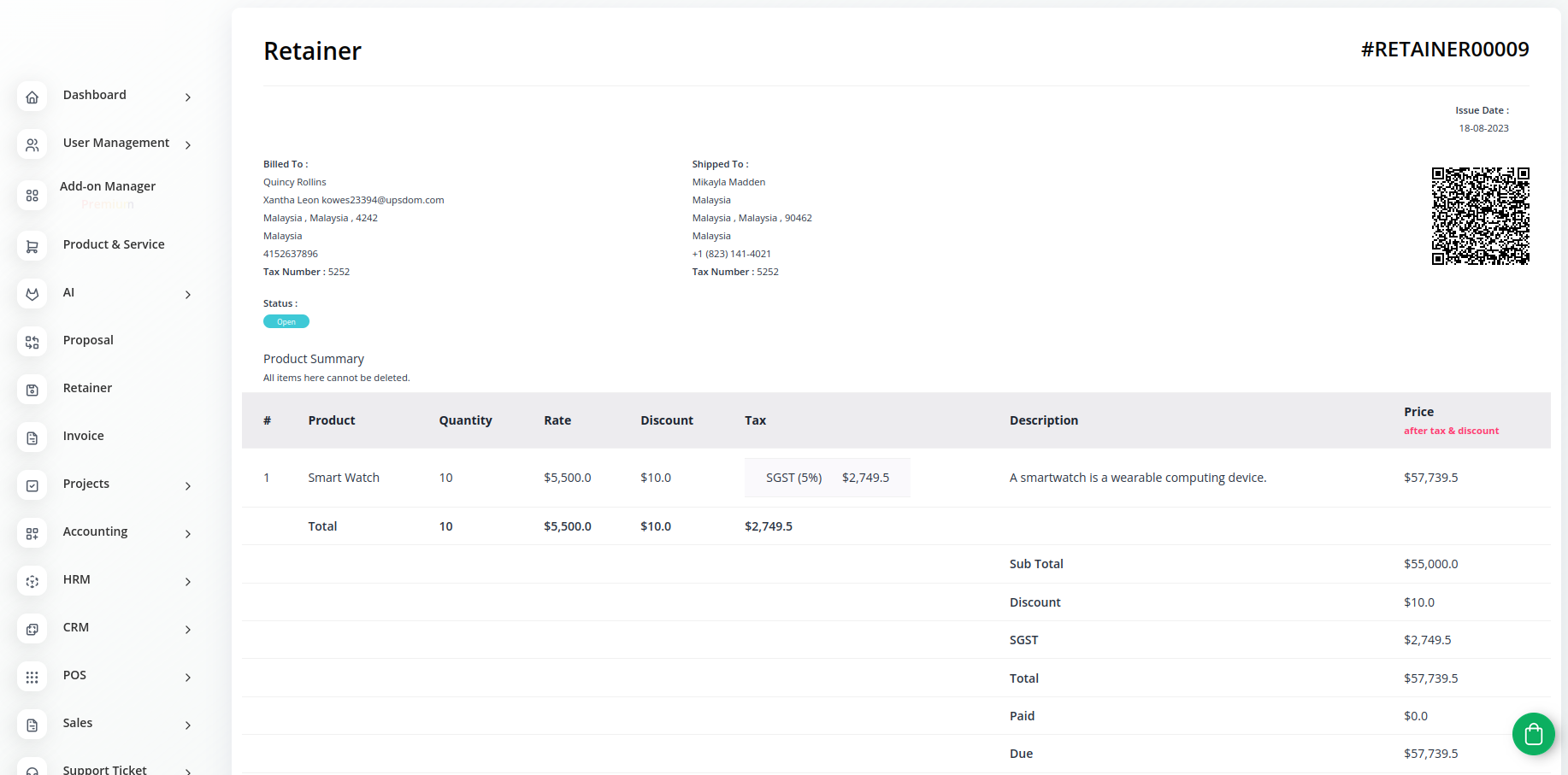

When you collect advance payments from your clients, they can’t be considered immediate income.

Retainer in accounting

The term “retainer” in accounting means the client pays a part or all of the services as an advance.

If, in case, the retainer is “pay for access,” it means the business or service provider must provide services to the client regularly for a set number of hours every month.

Also, the retainer payment must be paid immediately after the agreement is signed.

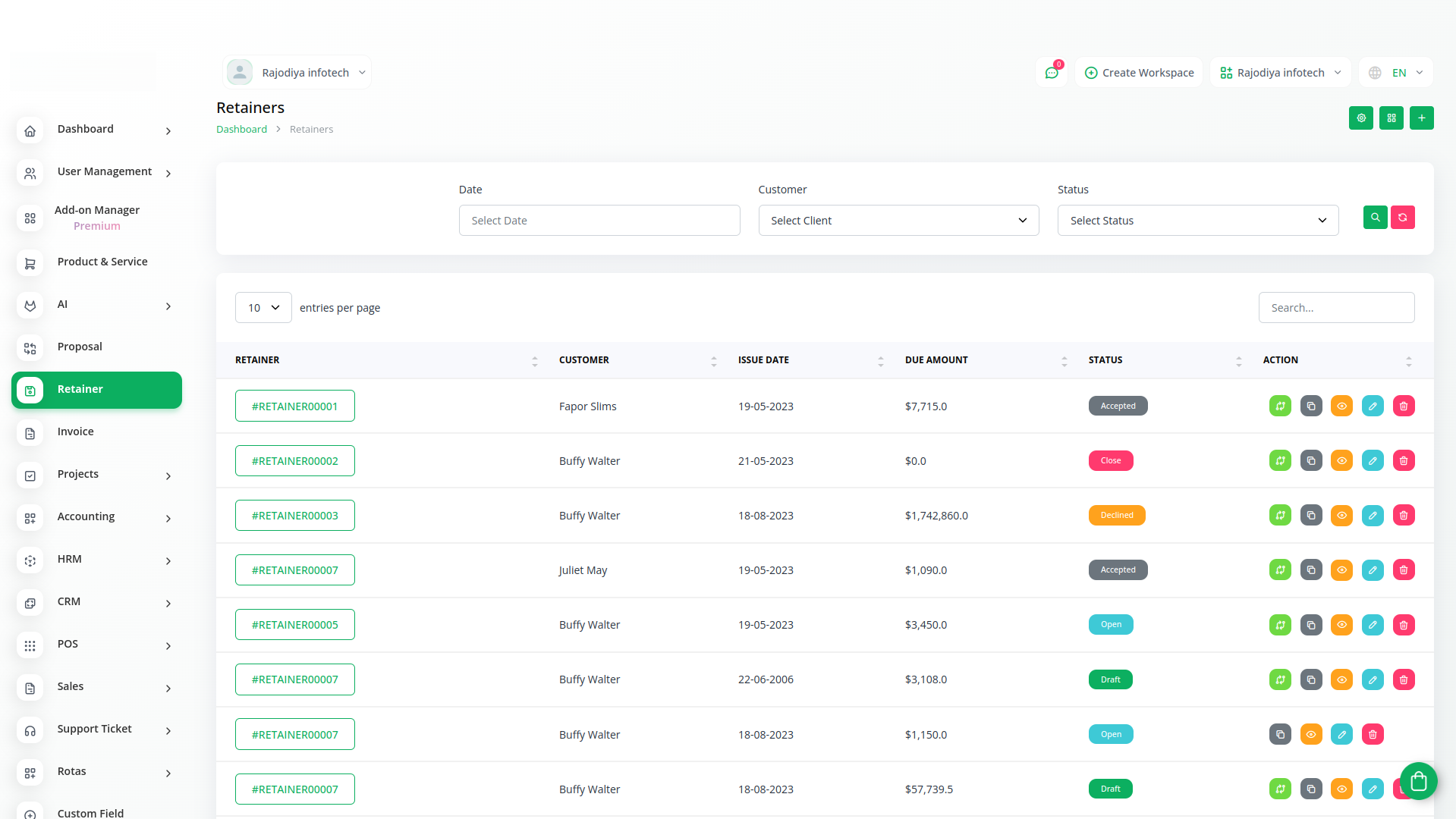

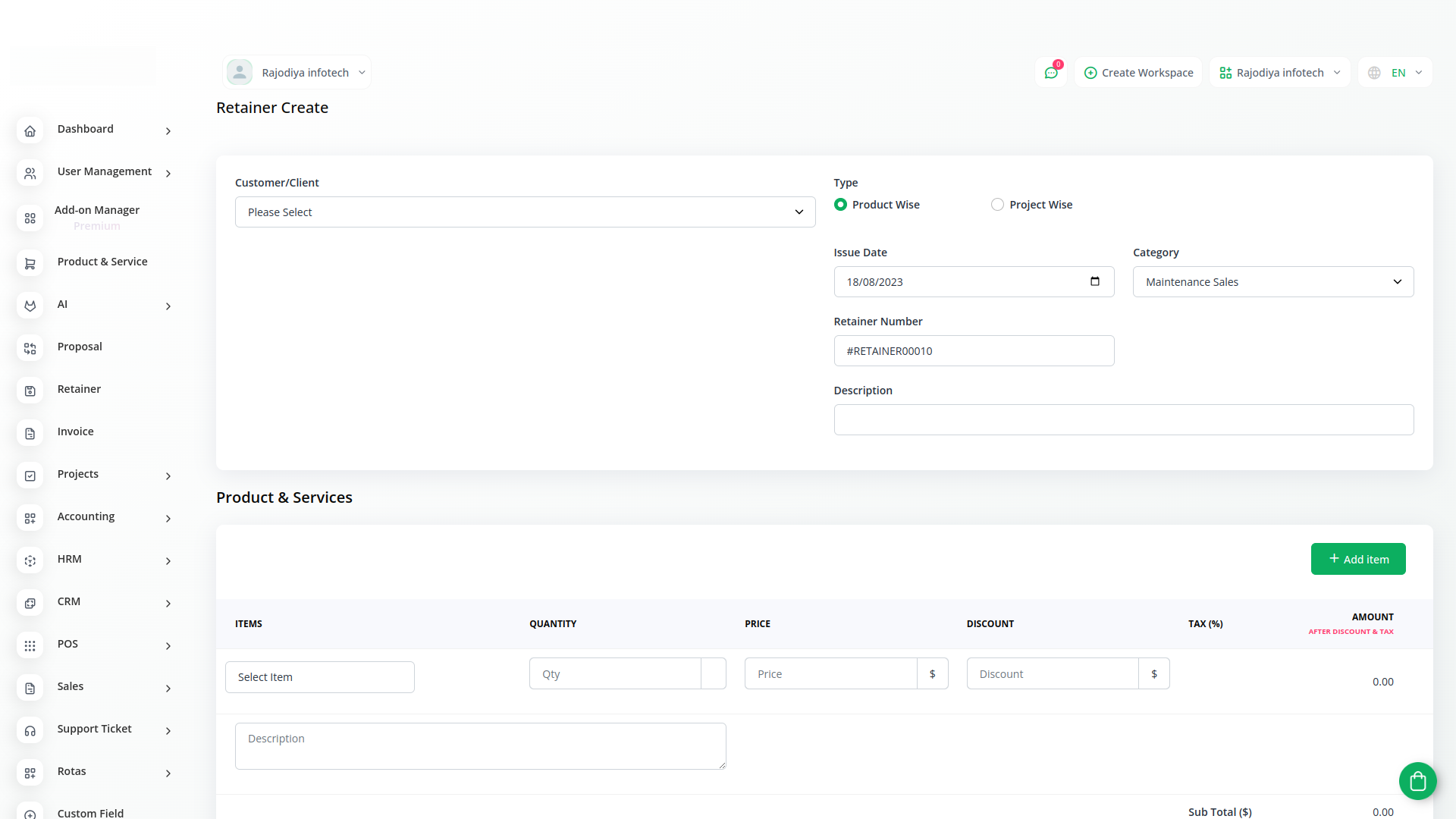

Why choose our Retainer system for your Business?

Because its a method of securing services for use when required. In other words, its a form of deposit or pre-payment.

Empower Your Workforce with our Retainer system

The term “retainer” in accounting means the client pays a part or all of the services as an advance.

- Reasonable Price

- Enjoy Unlimited Features

- Secure cloud storage

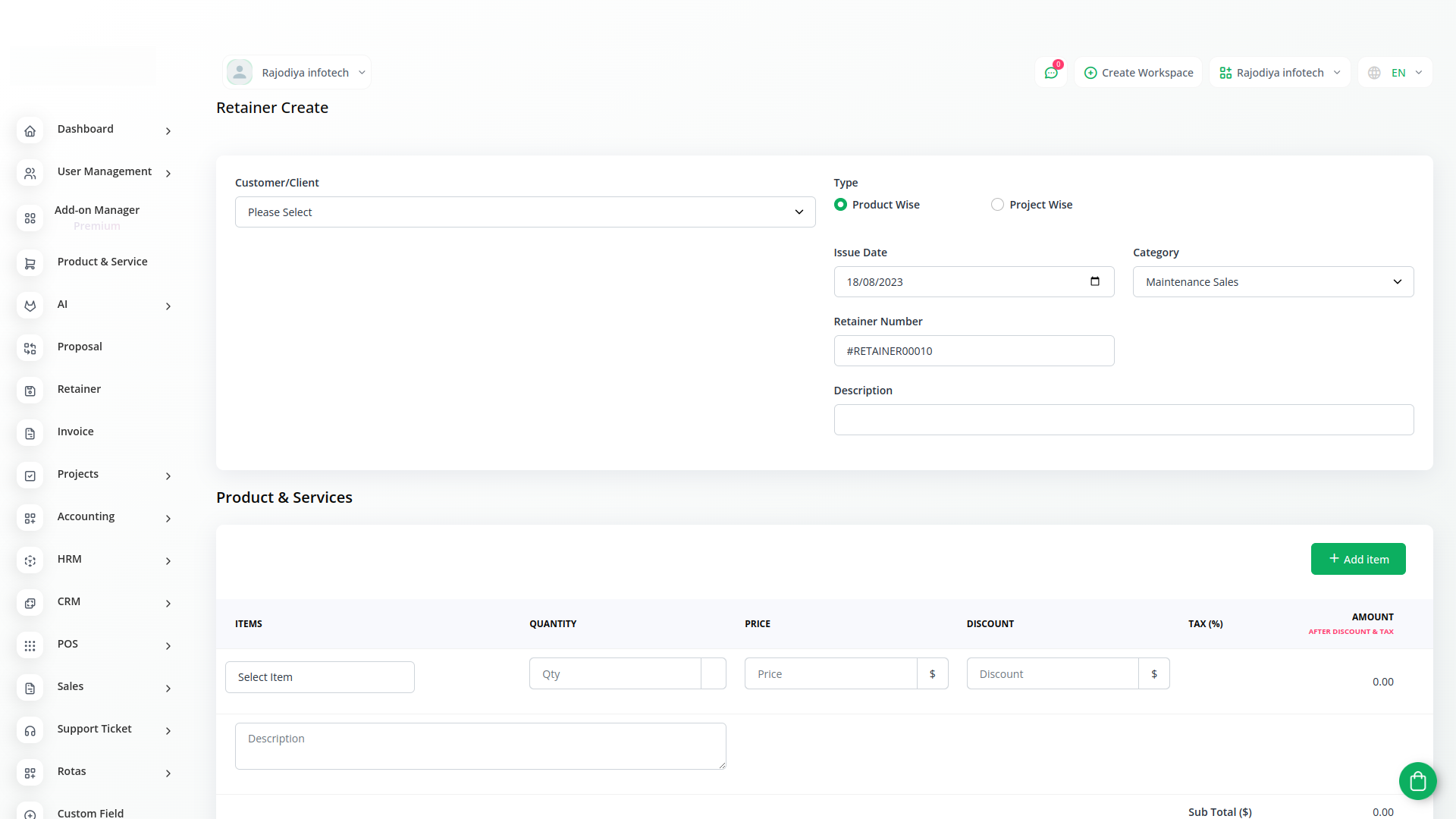

Review Other Business Softwares?

With our business softwares, you can conveniently manage all your business functions from a single location.